Benefits Built Around Your Business

Affordable, full-service solutions that help small businesses attract and keep great employees—without breaking the budget.

Running a small business is hard … CIS steps in as your back-end benefits team.

Running a small or midsize company is hard enough without juggling HR tasks, confusing regulations, and rising insurance costs. At Consolidated Insurance Solutions (CIS), we step in as your back-end benefits team—helping you design, manage, and support employee benefits that protect your people and your bottom line.

Why partner with CIS?

-

Outsourced HR support

Get the peace of mind of a dedicated benefits team without the overhead.

-

Smarter, cost-effective coverage

We shop across carriers for health, life, dental, vision, and annuities—tailored to your needs.

-

Compliance confidence

From IRS rules to ACA requirements, we help ensure your plans are compliant and tax-advantaged.

-

Employee satisfaction

Offering meaningful benefits helps you recruit, retain, and support your team

Recruit and retain versus recruit and train.

Employee turnover is one of the biggest hidden costs for small businesses. By offering meaningful benefits at little to no cost to you, you give your team a powerful reason to stay instead of leaving for larger competitors.

CIS makes it possible to provide benefits that build loyalty, reduce turnover, and protect your bottom line.

“Employee turnover costs small businesses up to 30% of a worker’s annual salary.”

— Source: Work Institute, 2020 Retention Report

The tax advantage: compliance that protects your business

Employee benefits aren’t just about taking care of your team—they’re also about staying compliant. The way your plan is designed can determine whether reimbursements remain tax-free or become taxable income. That’s where CIS comes in. We simplify the rules, reduce risk, and help you build benefits that work for everyone.

-

Your benefit plan design determines whether reimbursements are tax-free or taxable for employees. Under Title 26 CFR §1.105-11, employers offering self-insured medical reimbursement plans must structure them carefully to avoid being considered “discriminatory.”

-

If a plan favors highly compensated employees—such as offering richer coverage, higher reimbursement limits, or benefits not available to others—their reimbursements may become taxable. That can create surprise tax bills for owners and executives, and put the entire plan at risk.

-

CIS helps you:

Avoid discrimination pitfalls in plan design

Build cafeteria plans (IRC §125) that keep reimbursements tax-free

Develop written plans that meet federal requirements

Protect both owners and employees from unexpected tax surprises

-

We make sure your benefits stay both valuable and compliant—so you can focus on running your business.

Who we serve

Most small businesses rely on payroll companies or piecemeal solutions that provide minimal support at high cost. CIS gives you a better way—full-service benefits management without the overhead of a full HR department.

We partner with:

Growing businesses with 2–200 employees

Family-owned companies

Startups moving past the “bare minimum” stage

Businesses looking to attract and keep top talent

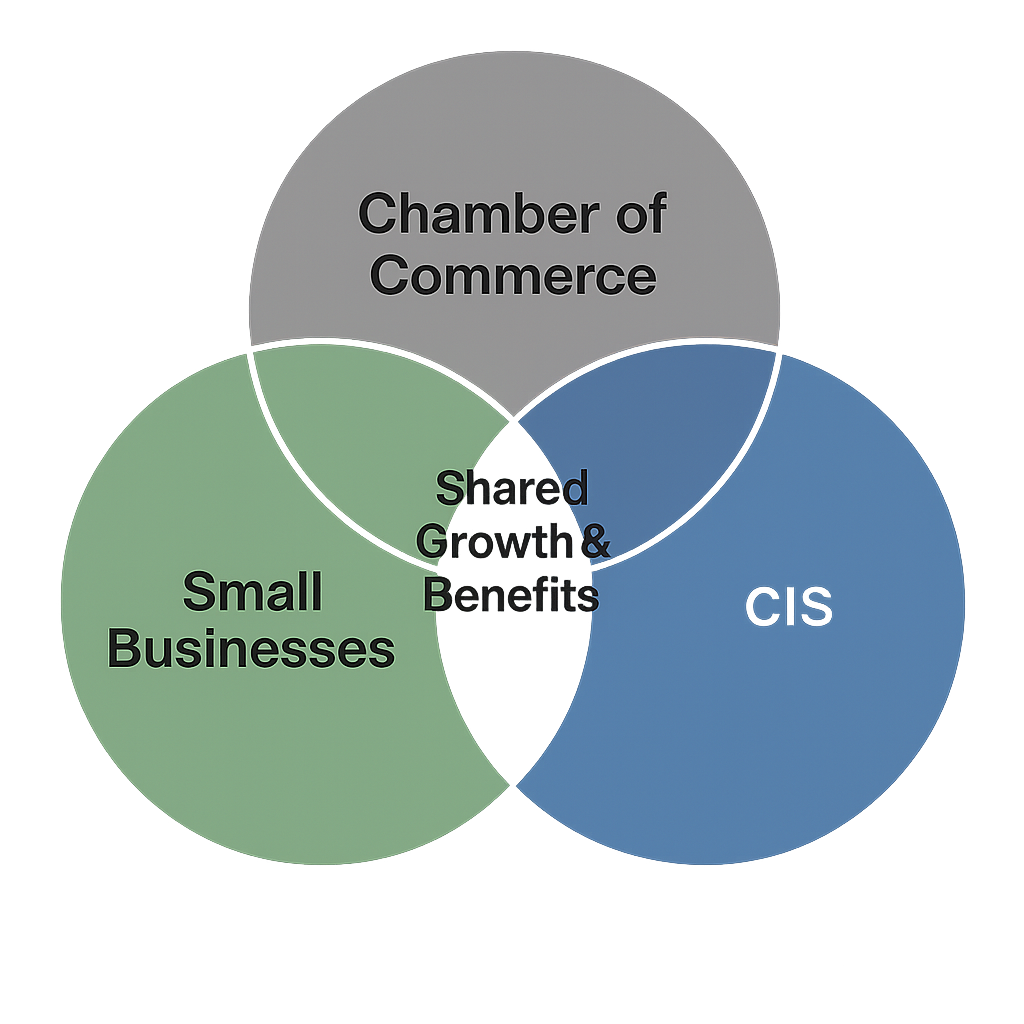

We also partner with Chambers of Commerce to extend these same benefits to entire business communities.

Chamber partnership solutions

Benefits that grow your business community

CIS also partners directly with Chambers of Commerce to expand access to affordable benefits for local businesses. Through these chamber-based plans, small businesses can tap into group benefits that are typically only available to larger organizations—while chambers enjoy a new revenue stream to support their mission.

How it works

Chamber-sponsored benefits → CIS sets up a tailored plan that chambers can offer to their member businesses.

Member value → Small businesses gain access to health, life, and retirement benefits at competitive rates.

Chamber advantage → Chambers receive a financial kickback for each participating business, creating a sustainable source of support for programs and growth.

Why it matters

Strengthens your local business community

Helps small businesses compete for talent

Provides chambers with a built-in fundraiser

Delivers cost-effective solutions without sacrificing quality

👉 With CIS, your chamber isn’t just supporting members—it’s investing in the long-term health and stability of your local business ecosystem.

Let’s build your solution

Your business is unique. So should your benefits. Whether you want to improve your current offerings, explore tax-advantaged strategies, or provide your employees with meaningful coverage, CIS is here to help.